𝐓𝐇𝐄 𝐎𝐑𝐈𝐆𝐈𝐍 𝐎𝐅 𝐀 𝐃𝐄𝐂𝐄𝐏𝐓𝐈𝐕𝐄 𝐒𝐘𝐒𝐓𝐄𝐌

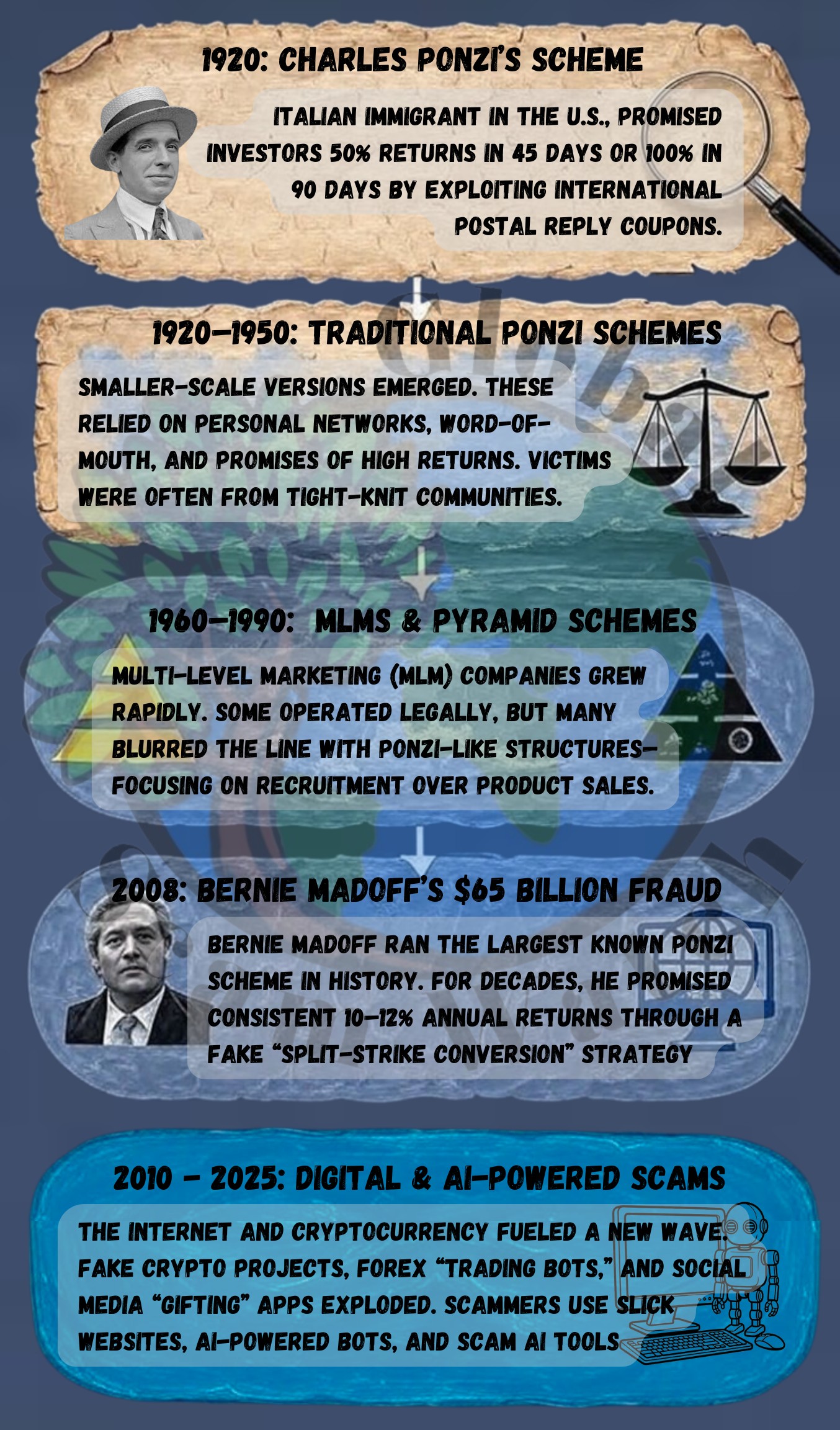

In the early 1920s, an Italian immigrant named Charles Ponzi became the face of one of the most infamous financial cons in history. He promised investors astronomical returns of 50 percent in just 45 days through a supposedly legitimate business involving international postal reply coupons. The concept sounded revolutionary at the time. Ponzi claimed he could exploit exchange rate differences to make quick profits.

In the early 1920s, an Italian immigrant named Charles Ponzi became the face of one of the most infamous financial cons in history. He promised investors astronomical returns of 50 percent in just 45 days through a supposedly legitimate business involving international postal reply coupons. The concept sounded revolutionary at the time. Ponzi claimed he could exploit exchange rate differences to make quick profits.

In reality, there was no sustainable business model. Ponzi paid older investors with money from newer ones, creating the illusion of profitability. As word spread and more people invested, the illusion grew until it could no longer be maintained. When new money stopped flowing in, the entire structure collapsed, leaving thousands of investors ruined.

Ponzi’s name would become forever linked to this type of financial deceit, which relies not on real investments, but on constant recruitment and false trust.

𝐌𝐎𝐃𝐄𝐑𝐍 𝐏𝐎𝐍𝐙𝐈 𝐒𝐂𝐇𝐄𝐌𝐄𝐒 𝐀𝐍𝐃 𝐒𝐎𝐂𝐈𝐀𝐋 𝐓𝐑𝐔𝐒𝐓

The core design of the Ponzi scheme has barely changed in a century. The difference lies in its delivery. Today, these schemes spread primarily through social media, private messaging apps, and online investment groups. They thrive on personal connections and emotional persuasion.

Modern fraudsters understand people trust their friends more than anonymous strangers. Many of today’s scams operate within “gifting circles” or “blessing looms,” where participants are encouraged to “gift” money to others with the promise of receiving a larger sum later. The pitch is dressed in words like “community,” “sisterhood,” or “financial empowerment,” but it still depends on a constant flow of new recruits, once recruitment slows, the circle collapses, leaving those at the bottom with nothing.

𝐓𝐇𝐄 𝐁𝐋𝐔𝐑𝐑𝐄𝐃 𝐋𝐈𝐍𝐄 𝐁𝐄𝐓𝐖𝐄𝐄𝐍 𝐌𝐋𝐌 𝐀𝐍𝐃 𝐏𝐘𝐑𝐀𝐌𝐈𝐃 𝐒𝐂𝐇𝐄𝐌𝐄𝐒

Multi level marketing operations, or MLMs, often sit in a gray area between legitimate business and deceptive structure. In principle, MLMs sell real products. In practice, many depend heavily on recruitment rather than sales, mirroring the flow of a Ponzi scheme.

When most of the money comes from bringing in new members instead of selling real goods, the structure becomes unsustainable. Those at the top profit while those at the bottom lose. The language of entrepreneurship and self-employment disguises what is, at its core, a pyramid model where recruitment is the true product.

𝐂𝐑𝐘𝐏𝐓𝐎 𝐒𝐂𝐇𝐄𝐌𝐄𝐒: 𝐓𝐇𝐄 𝐃𝐈𝐆𝐈𝐓𝐀𝐋 𝐅𝐑𝐎𝐍𝐓𝐈𝐄𝐑 𝐎𝐅 𝐃𝐄𝐂𝐄𝐏𝐓𝐈𝐎𝐍

The cryptocurrency boom introduced a new playground for fraud. Scammers promote fake digital coins, AI-powered trading bots, or investment programs promising guaranteed profits. Investors are shown slick dashboards displaying fictional earnings and fabricated trade results.

Behind the scenes, there are often no trades and no blockchain records. The funds of new investors are simply used to pay earlier participants, maintaining the illusion of success. When withdrawals increase or recruitment slows, the operators disappear, often leaving no trace. Many of these scams also have hidden exit fees designed to keep the victims locked in.

Some fraudulent platforms have even claimed to use AI prediction engines to "outsmart the market." These systems appear advanced, but their purpose is only to lend technical credibility to an old deception.

𝐅𝐎𝐑𝐄𝐈𝐆𝐍 𝐄𝐗𝐂𝐇𝐀𝐍𝐆𝐄 𝐒𝐂𝐀𝐌𝐒 𝐀𝐍𝐃 𝐓𝐇𝐄 𝐀𝐈 𝐅𝐀𝐂𝐀𝐃𝐄

Foreign exchange, or forex, has become another favorite landscape for Ponzi operations. Fraudulent brokers promise investors consistent profits through algorithmic or AI-driven trading systems. They show elaborate charts and simulated trades, appearing scientific and legitimate.

Victims are convinced a machine is doing the hard work. In many cases, no real trading occurs. The platforms are designed to look active while simply recycling incoming deposits to keep the illusion alive. Some victims are even told they can only withdraw after recruiting new members, revealing the Ponzi structure underneath.

𝐀𝐈 𝐀𝐒 𝐁𝐀𝐈𝐓 𝐀𝐍𝐃 𝐀𝐒 𝐀 𝐓𝐎𝐎𝐋

Artificial intelligence has become both the bait and the engine of modern scams. Scammers use AI to create believable investment dashboards, automated communications, and fake trading data that appear authentic. AI-generated voices and faces are also used to impersonate company representatives or successful investors.

For more on this topic read AI Scam-As-a- Service, .

𝐓𝐇𝐄 𝐄𝐍𝐃𝐋𝐄𝐒𝐒 𝐋𝐎𝐎𝐏 𝐎𝐅 𝐓𝐑𝐔𝐒𝐓 𝐀𝐍𝐃 𝐆𝐑𝐄𝐄𝐃

Whether it appears as a postal coupon investment in 1920 or an AI-powered crypto platform in 2025, the foundation remains unchanged. A Ponzi scheme feeds on trust, urgency, and manufactured evidence, it asks people to believe in easy profit and to bring their friends along for the ride.

Technology has changed, but human psychology has not. The con remains eternal because the illusion of effortless wealth is a story people still want to believe.

- Log in to post comments