In a world gripped by housing crises, from Toronto with sub-one percent vacancy rates to London with average rents exceeding £2,000, scammers are turning the dream of home into a nightmare. The insidious email you received, masquerading as a payment update from Comptable•ca, is not an isolated case. It forms part of a worldwide epidemic of rental fraud that begins with fake listings and escalates to payment phishing.

Globally, these scams target the vulnerable: students, immigrants, and families racing against deadlines in overheated markets. In the United States alone, real estate fraud losses reached $145 million in 2023 and have continued climbing into 2025. This exposé unmasks how these schemes operate from New York to Sydney, their explosive growth during the COVID-19 pandemic, and their viral resurgence today. It also highlights the red flags and defenses every renter must know.

Globally, these scams target the vulnerable: students, immigrants, and families racing against deadlines in overheated markets. In the United States alone, real estate fraud losses reached $145 million in 2023 and have continued climbing into 2025. This exposé unmasks how these schemes operate from New York to Sydney, their explosive growth during the COVID-19 pandemic, and their viral resurgence today. It also highlights the red flags and defenses every renter must know.

Fake Listings: The Gateway to Global Rental Fraud

Fake rental listings serve as the gateway to this fraud frenzy. Scammers hijack legitimate advertisements from sites such as Zillow, Rightmove, or Domain.com.au, and repost them on Craigslist, Facebook Marketplace, or Gumtree at suspiciously low prices. A Manhattan studio might be listed for $1,000 or a Berlin flat for €800.

The listings often use stolen photos, sometimes still watermarked from real estate databases, paired with generic descriptions and urgent pleas such as “First come, first served, pay now to hold.” The so-called landlord, claiming to be overseas or in quarantine, pressures victims into wiring deposits through systems like Zelle in the United States, Faster Payments in the United Kingdom, or BPAY in Australia before any viewing takes place.

Once the payment is sent, the scammer vanishes, leaving the victim homeless and out thousands of dollars. In the United Kingdom, Action Fraud reported over 4,000 cases in 2024, totaling more than £6 million in losses. In Australia, the national competition regulator recorded AUD 10 million in damages. For those who secure actual tenancies, the scam evolves into payment update frauds, where cybercriminals spoof landlord emails to reroute ongoing rent to their own accounts.

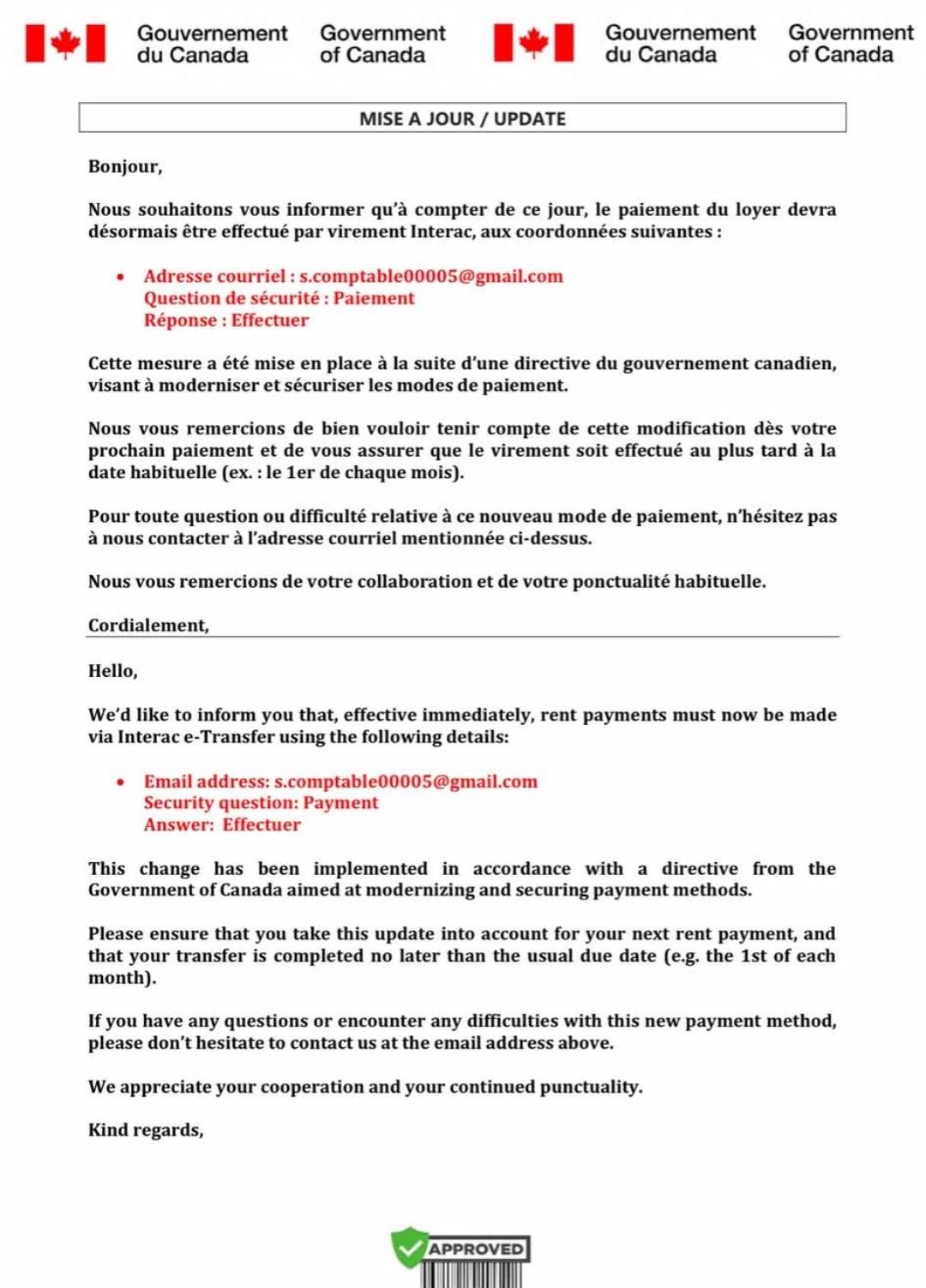

Payment Update Scams: Phishing Masquerading as Policy

These phishing messages often appear professional, citing “new security protocols” or “updated compliance systems” to appear legitimate. Victims are urged to switch to irreversible payment methods such as wire transfers or cryptocurrency. Some messages even include fake security questions that automatically approve the transfer.

This represents business email compromise on steroids, blending urgency with forged logos and convincing wording to steal funds and personal information. The damage can recur monthly if not detected quickly.

A Global Timeline: From Niche Hustle to Pandemic Explosion and 2025 Resurgence

Rental scams are not new, but they have evolved dramatically. Before 2020, they were small-scale operations, often limited to hijacked Craigslist ads costing renters millions annually. Europe saw early versions targeting expatriates through platforms such as Leboncoin in France and Immowelt in Germany. In Australia, BPAY diversion scams began rising in 2018 during student housing booms.

COVID-19 acted as the super-spreader. Lockdowns made in-person tours impossible, forcing renters online and driving a 300 percent surge in digital searches. With unemployment rising and eviction freezes in place, scammers thrived on desperation. Reports doubled in 2020, with victims in cities like New York losing thousands to phantom rentals explained away by “pandemic restrictions.”

The United Kingdom saw a 50 percent increase in Gumtree rental scams. Across Europe and Australia, fake “virtual tour” traps emerged, preying on international students and remote workers. Global losses hit $145 million by 2023 as digital dependence deepened.

After vaccines arrived, reports briefly dropped, but scammers quickly adapted. In 2024 and 2025, the use of artificial intelligence made it possible to generate fake listings, fake photos, and fluent correspondence at scale. Tight vacancy rates (three percent in the United States and one percent in Australia) have kept demand high, pushing one in three renters to encounter a scam attempt.

While report numbers dipped slightly in some regions, losses grew. In Canada, average victim losses rose by 21 percent to over $2,000, with nearly half unrecovered. U.S. landlords also faced a surge in fake applications, while Europe battled SEPA payment phishing and Australia saw crypto-based rent requests. Immigration spikes and remote work have only fueled the flames.

Spotting the Trap: Red Flags of a Rental Payment Scam

🌐 Too Good to Be True

If a listing is far below market value or suddenly offers discounts, it is a bait tactic.

💸 Irreversible Payments

Demands for wire transfers, cryptocurrency, or gift cards are red flags. Use credit cards or verified platforms instead.

🏠 No In-Person Verification

Excuses such as being out of the country or offering “virtual-only tours” are common. Legitimate landlords arrange showings.

📧 Spoofed Communications

Scammers use free email services or mismatched domains to appear legitimate. Check sender addresses carefully.

🧾 Upfront Fees Without Contracts

Requests for deposits before viewing or lease signing should be treated as fraud.

📷 Stolen Photos

Reverse image search can reveal if photos are lifted from other listings.

Arm Yourself: How to Stay Safe in a Rigged Market

🔎 Verify Ruthlessly

Search the address and landlord’s name with the word “scam.” Use verified rental platforms and contact property owners through official numbers.

💰 Use Safe Payment Methods

Prefer escrow services or traceable options such as PayPal Goods and Services. Never send “family” transfers that bypass fraud protection.

🛡️ Secure Your Tech

Enable two-factor authentication, keep antivirus software updated, and monitor bank accounts regularly.

📣 Report Aggressively

File complaints with your national fraud agency:

🇨🇦 Canada - Canadian Anti-Fraud Centre (CAFC) – The national agency for reporting online, financial, and rental scams.

👉 Website: www.antifraudcentre-centreantifraude.ca

🇺🇸 United States - Federal Trade Commission (FTC) – Handles consumer and rental fraud reports nationwide.

👉 Website: www.reportfraud.ftc.gov

🇬🇧 United Kingdom - Action Fraud – The central reporting service for online and property-related scams.

👉 Website: www.actionfraud.police.uk

🇦🇺 Australia - Australian Competition and Consumer Commission (ACCC) – Scamwatch

Tracks and investigates scams including housing, investment, and payment fraud.

👉 Website: www.scamwatch.gov.au

🇳🇿 New Zealand - Netsafe – The official body for reporting online scams, cyberbullying, and fraud.

👉 Website: www.netsafe.org.nz

🇪🇺 European Union (General) - European Consumer Centres Network (ECC-Net) – Assists with cross-border rental and consumer fraud cases.

👉 Website: www.eccnet.eu

🇮🇪 Ireland - National Cyber Security Centre (NCSC) & Gardaí – Report online and property scams through local Garda stations.

👉 Website: www.ncsc.gov.ie

🇸🇬 Singapore - ScamShield & Police Anti-Scam Centre – Combines mobile app alerts with a national hotline for scam victims.

👉 Website: www.scamalert.sg

🇭🇰 Hong Kong - CyberDefender / Hong Kong Police Force – Reports cybercrime, property, and payment scams.

👉 Website: www.cyberdefender.hk

🇿🇦 South Africa - SA Fraud Prevention Service (SAFPS) – Handles identity, payment, and rental scams.

👉 Website: www.safps.org.za

As artificial intelligence enhances scam sophistication and housing shortages persist, vigilance remains the best defense. Rental platforms must verify listings. Governments must regulate. Until then, question every “update” and every too-good offer.

Your financial security depends on it.

If you spot a scam, share your experience. Exposure is the antidote.

- Log in to post comments